Key Points:

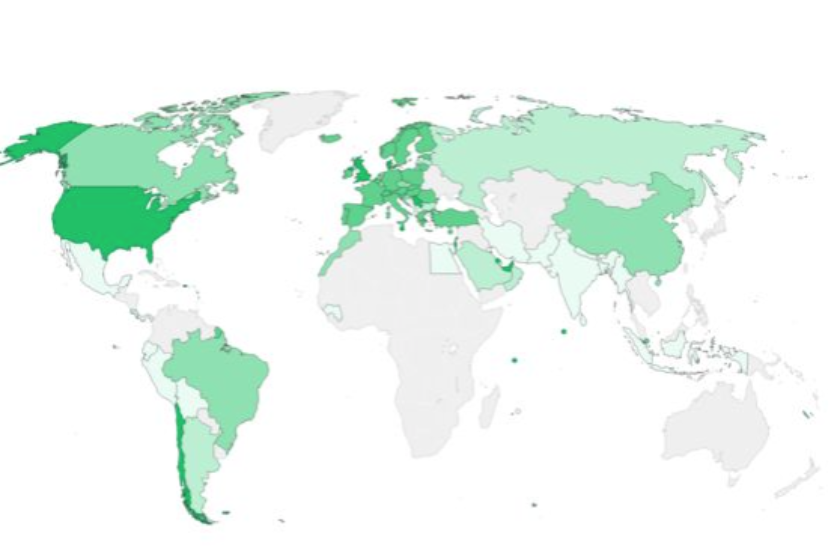

- Worldwide coronavirus cases surpass 125.87 million with over 2.762 million official deaths

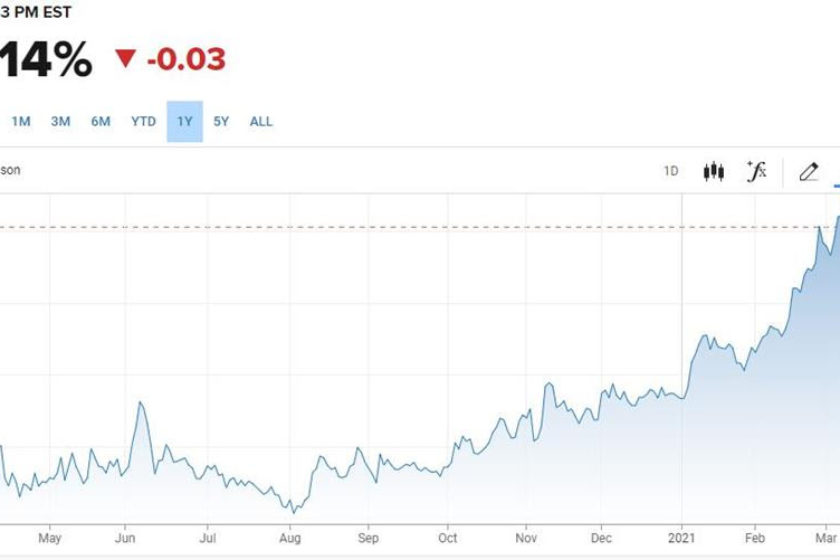

- Equity markets charge higher amid risk off tone

- Fed’s Evans says inflation topping out over 3% would be a worry as the Fed reinforces their willingness to tolerate higher inflation, he expects rates to remain until 2024

- Germany has reported over 22,000 coronavirus cases and 228 deaths in the latest update

- The Suez Canal remains blocked by a 400-meter Japanese container ship as dozens of ships backup