Monday 15/03

12:15pm, AUD, RBA Gov Lowe Speaks

3:00pm, CNY, Industrial Production y/y

Forecast 31.20%

Previous 7.30%

3:00pm, CNY, Retail Sales y/y

Forecast 32.00%

Previous 4.60%

Tuesday 16/03

Tentative, JPY, BOJ Gov Kuroda Speaks

Monday 15/03

12:15pm, AUD, RBA Gov Lowe Speaks

3:00pm, CNY, Industrial Production y/y

Forecast 31.20%

Previous 7.30%

3:00pm, CNY, Retail Sales y/y

Forecast 32.00%

Previous 4.60%

Tuesday 16/03

Tentative, JPY, BOJ Gov Kuroda Speaks

The two charts below show a couple of significant trends that have developed in financial markets since August last year. The issue here is that these two trends cannot continue on together indefinitely. One of them is going to have to reverse, at least to a significant degree.

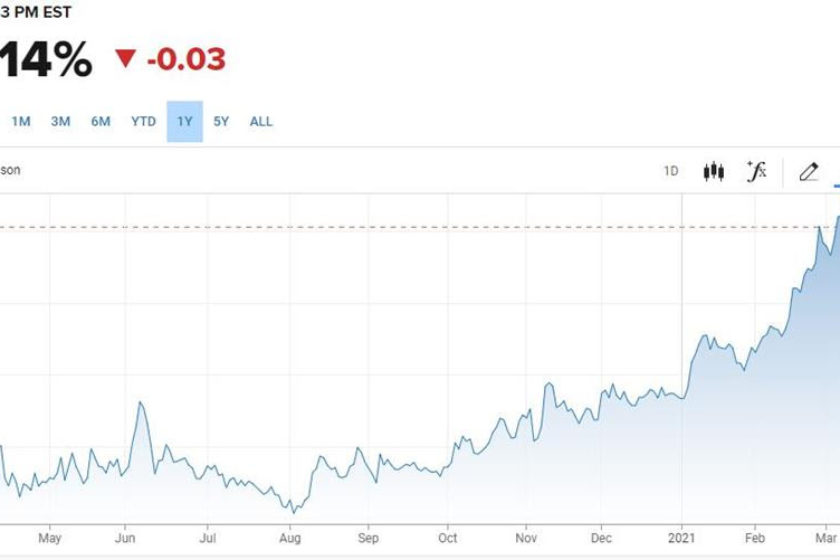

The top chart is US 10-year yields that have risen from a low of around 0.52% in August last year, to currently trade just over 1.50%. The bottom chart is the NZDUSD, used here as a proxy for showing the broad-based USD weakness seen since September. Rising US interest rates will eventually support the USD. It is extremely unlikely that US interest rates keep rising and the US dollar keeps falling. The question markets are asking themselves is at what point does one of these trends reverse? If US 10-year yields fall back to 1.0% or so, the USD could easily continue to decline in value. But if 10-year yields continue to rise, it’s likely the USD will face a sudden and sharp reversal of fortunes. Read more

• Worldwide coronavirus cases surpass 117.727 million with over 2.61 million official

deaths.

• Biden’s 1.9T coronavirus stimulus relief fund has been approved by congress.

• Japanese (final) GDP for the fourth quarter comes in at 2.8% slightly lower than the 3.0% predicted and lower than the third quarter’s 5.3%

• NZ Manufacturing activity over the fourth quarter slumped to -0.6% from the prior quarter 10.0%

• NZ ANZ Business Confidence index alarmingly dropped to 0.0 from 11.8 in February.

• Japan’s government wants a 2-week extension of the Tokyo state of emergency.

• The CDC is reporting lower US cases of coronavirus along with fewer recent deaths.

Monday 08/03

11pm, GBP, BOE Gov Bailey Speaks

Wednesday 10/03

11am, AUD, RBA Gov Lowe Speaks

Tuesday 01/03

4am, USD, ISM Manufacturing PMI

Forecast 58.7

Previous 58.7

4.30pm, AUD, RBA Rate Statement

Wednesday 02/03

1.30pm, AUD, GDP q/q

Forecast 2.40%

Previous 3.30%

The Reserve Bank of New Zealand has left its Large Scale Asset Purchase Program, at NZD $100B Wednesday, while keeping the cash rate unchanged at 0.25%. The RBNZ said in their statement they will maintain its stimulatory policy until inflation is sustained at the 2.0% target point. The work required to accommodate negative rates is now done although the RBNZ is very unlikely to cut rates again in this cycle. Having said that the RBNZ is willing to add further stimulus if required but it looks increasingly like a long shot that it will be necessary. Increases to the cash rate look to be a long way away possibly late 2022 depending on inflation as mentioned. From now over the following months, the RBNZ spoke of uncertain times ahead, relative to how the global community reacts and recovers based on coronavirus vaccine rollouts.

Read more

• Worldwide coronavirus cases surpass 112.1 million with over 2.48 million official

Deaths.

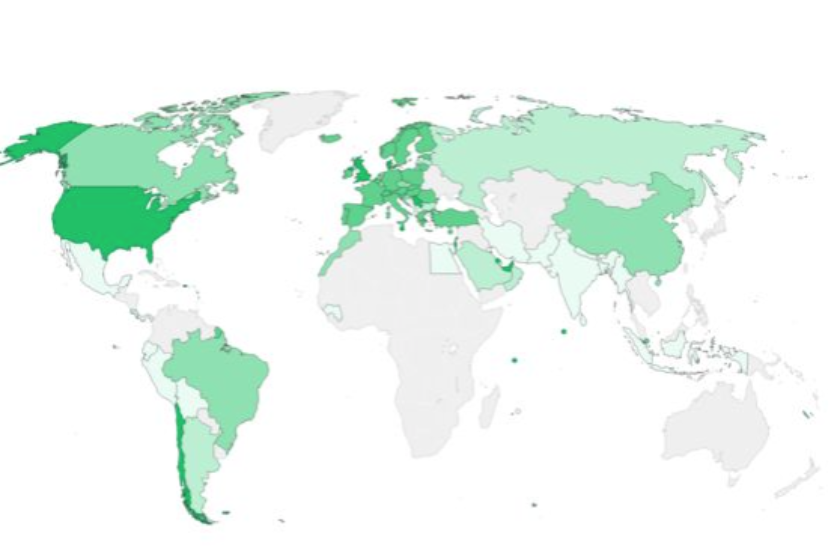

It was good to see a bit of excitement in the New Zealand Dollar develop Monday after a slow 2 to 3 weeks of little movement and benign economic activity. The kiwi climbed out of its recent range posting 0.7340 against the greenback, an early April 2018 level and looks poised to click higher. S&P (Standard & Poor’s) credit agency raised the New Zealand Credit rating from AA to AA+ saying the economy is recovering quicker than most other countries attributed to containing the virus well. S & P said they expect fiscal indicators to remain over the next few years and GDP to grow to about 3.2% between 2022 and 2024. This would be some effort as New Zealand hasn’t been able to achieve this since January 2019.

Read more