Key Points:

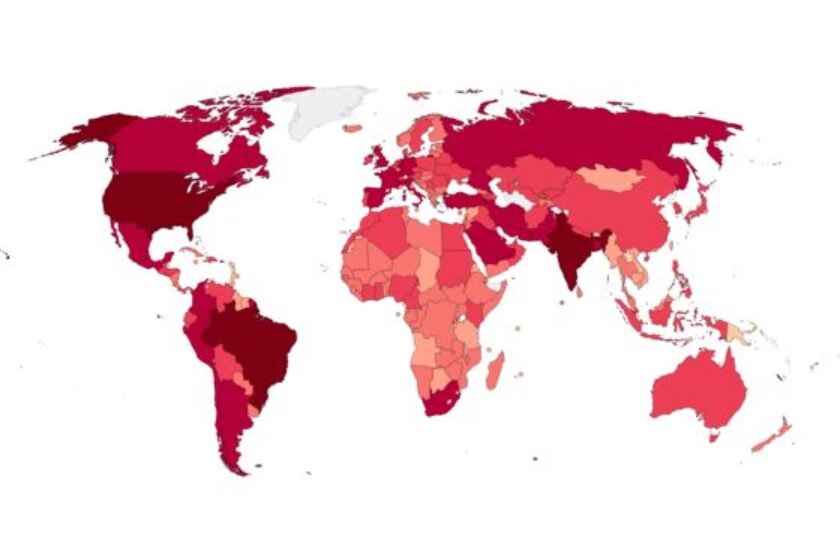

• Worldwide coronavirus cases surpass 199.022 million with over 4.240 million official deaths.

• Australian Bank Holiday saw a quit start to the week.

• Covid fears send Oil and stocks lower Monday.

• Sydney, Australia has reported another 207 new cases of coronavirus Monday.

• New Zealand’s Medal Tally- 4 Gold, 3 Silver, 4 Bronze making us twelfth on the medal table.

• AUD to come under selling pressures if the RBA delay their taper.

• Japan extended its state of emergency to Osaka recently and 3 areas near Tokyo to avoid a spike in coronavirus cases in efforts to avoid a possible system collapse during the Olympics. Read more