Market Overview

Key Points:

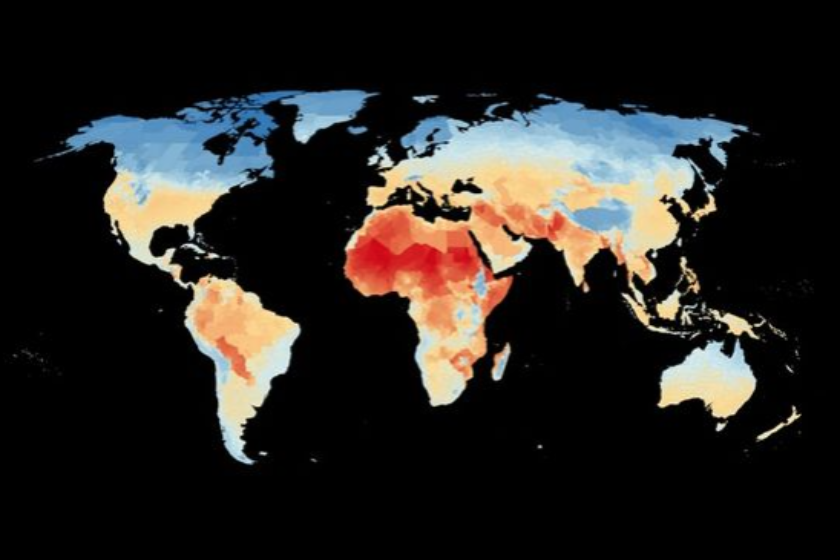

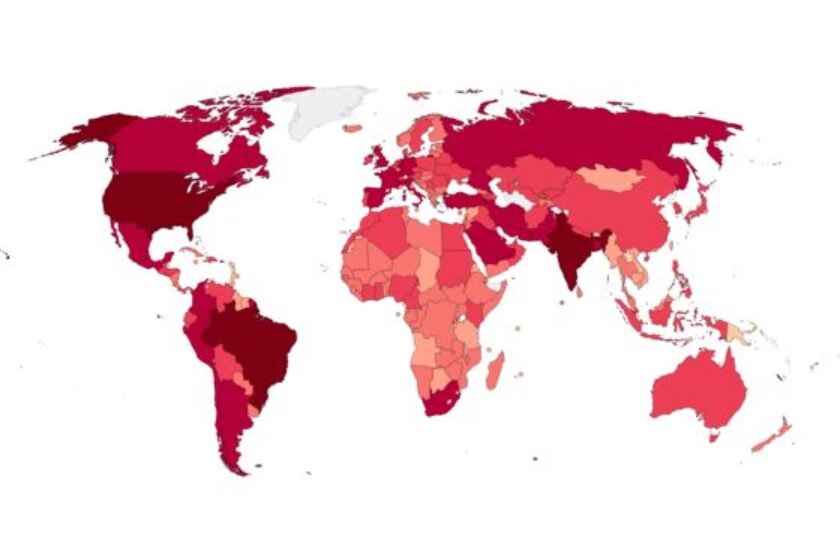

• Worldwide coronavirus cases surpass 236.079 million with over 4.821 million official deaths.

• New Zealand has 342 active cases of coronavirus with 35 new cases yesterday. Meanwhile, the Australian State of New South Wales reported 496 new cases and 8 deaths yesterday with Victoria reporting 1466 new cases with 8 deaths

• US Non-Farm Payroll reports for September came in at 194,000 compared to 500,000 consensus

• Comments from ex-Prime Minister Tony Abbot on Taiwan disappoint the Chinese Foreign Ministry

• The NZ Truckometer – a GDP indicator, surged in September representing increased traffic volume and improving recent supply chain bottlenecks

• Crude Oil breaks into the 80’s as demand and shortages continue

• Offshore Bond holders of Evergrande have not received interest payments and may not meet the Monday (US time) deadline sparking risk off market trading conditions Read more