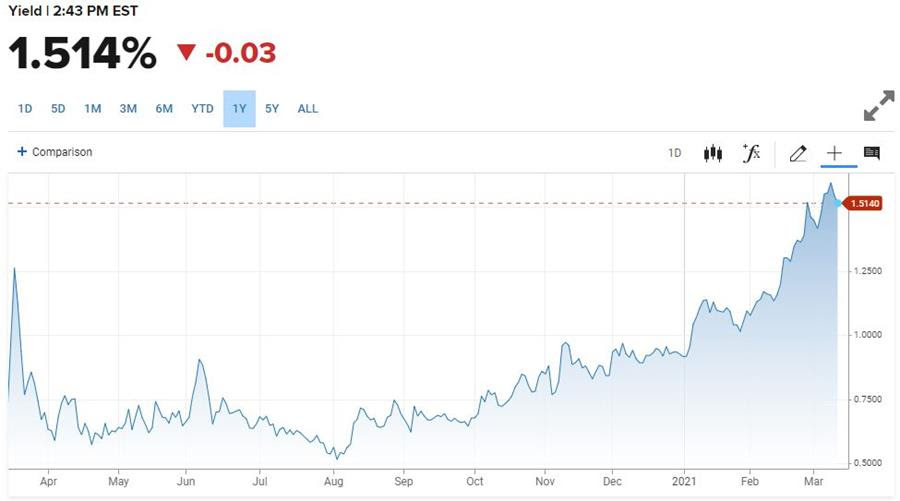

The two charts below show a couple of significant trends that have developed in financial markets since August last year. The issue here is that these two trends cannot continue on together indefinitely. One of them is going to have to reverse, at least to a significant degree.

The top chart is US 10-year yields that have risen from a low of around 0.52% in August last year, to currently trade just over 1.50%. The bottom chart is the NZDUSD, used here as a proxy for showing the broad-based USD weakness seen since September. Rising US interest rates will eventually support the USD. It is extremely unlikely that US interest rates keep rising and the US dollar keeps falling. The question markets are asking themselves is at what point does one of these trends reverse? If US 10-year yields fall back to 1.0% or so, the USD could easily continue to decline in value. But if 10-year yields continue to rise, it’s likely the USD will face a sudden and sharp reversal of fortunes.

The case for a weaker USD over the course of 2021 is compelling and as such there is now an extreme amount of speculative short (sold) USD positions in the market. That leaves the USD in a vulnerable position for a nasty short squeeze should something trigger such a move. Rising US 10-year yields could easily be that trigger if they continue heading north. Alternatively, the US Federal Reserve could step in to help drive long term interest rates lower, therefore underwriting a continuation of the USD bearish trend, but so far they’ve given no hint they are prepared to do that. The decline in the NZDUSD last week to around 0.7100 was largely driven by disappointment that Fed Chair Powell failed to signal any concern with rising 10-year yields.

If long term yields do continue to rise, then we believe the Fed will eventually be forced to act, probably implementing some form of “yield curve control”. But between now and then, further gains in long term US yields leaves the US dollar vulnerable to a sharp correction which could easily see the NZDUSD sub 0.7000 and the AUDUSD sub 0.7500.

Just how much further US yields need to rise to trigger such a move in the USD, is the big question?