Get your free online quote

Australia

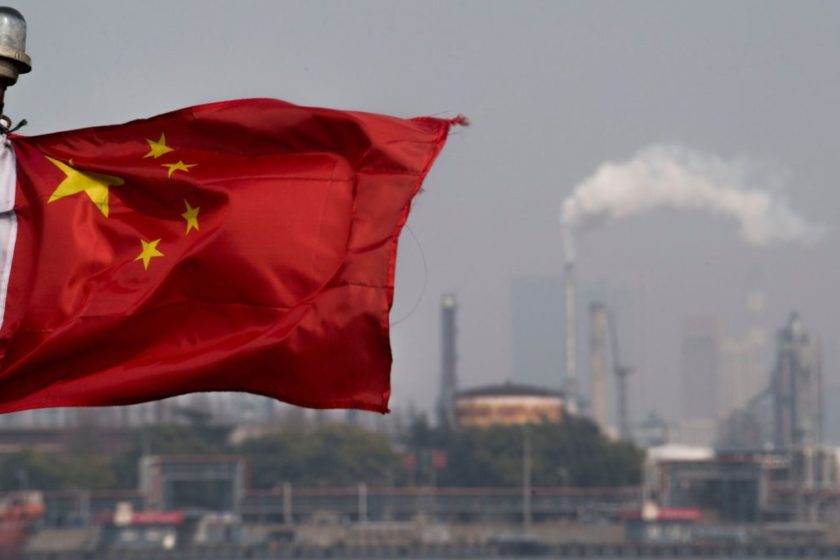

The Australian Dollar has been volatile in the past 24 hours after starting the week at 0.7080. The FOMC minutes bought nothing new to markets Thursday morning as they highlighted ongoing global uncertainty and the possible flow on effects from a slowdown in Europe and China. Equities all closed higher with the Aussie Dollar holding recent strength. Wage growth in Australia went backwards in the December quarter according to statistics wage growth grew by 0.5% coming in below the expected 0.6% pace expected. Unemployment data came in better than expected Thursday when employment was higher for January with employment jumping by 39,000 with 65,400 additional fulltime people and a downturn of 26,300 part time people. The wage data pushed the Aussie higher across the board on the news, against the greenback to 0.7205. Within minutes however, the AUD was back under pressure after Westpac suggested the RBA will cut interest rate twice this year. Overnight, reports of China blocking Australian imports of coal pressured the AUD further.

New Zealand

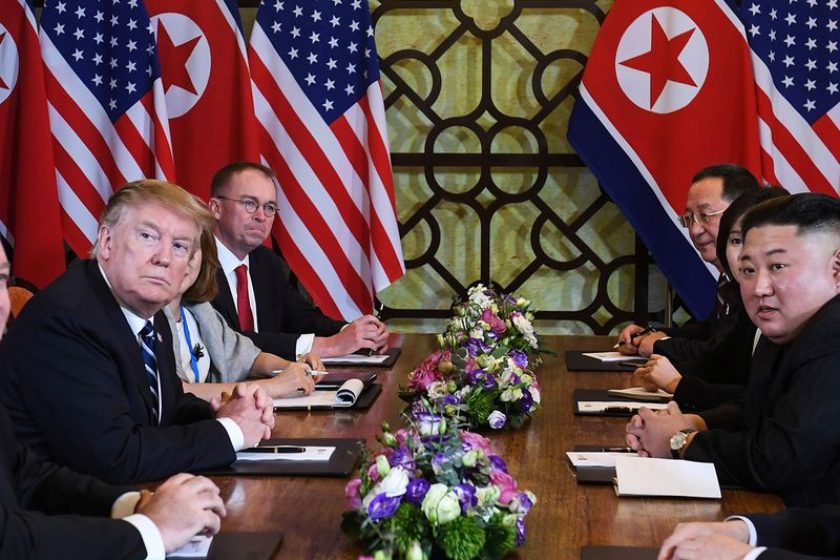

Prices in the Global Dairy Auction held overnight Wednesday showed another healthy rise of 0.9% increase, this is the sixth consecutive price increase. A total of 25325 Metric Tones of product was sold with milk powder and cheddar making the most gains of around 2.8% and 2.95% respectively. President Trump earlier comments to media were positive at the end of last week’s Beijing trade talks. He said the meetings went “extremely well” with further talks expected to continue today and tomorrow in Washington. The meeting in part will cover the pledge by China to purchase a significant amount of goods and services from the US. The US have highlighted the need for structural changes to be made in China. China more than ever looks to be engaged to reach a deal with the US. Next week’s main event on the docket will be Retail Sales ending January quarter. Read more