Ever heard the phrase “timing is everything”? Well, this couldn’t be more true when it comes to currency exchange. Whether you’re sending money overseas, paying for a holiday, or managing business payments, knowing when to exchange New Zealand Dollars (NZD) for Australian Dollars (AUD) can make a surprising difference.

But how do you figure out the best time to act? Don’t worry—we’ve got you covered. Let’s dive into some insider tips, clever tools, and expert advice to help you make smarter, better-timed transfers.

Why Timing Your NZD to AUD Exchange Matters

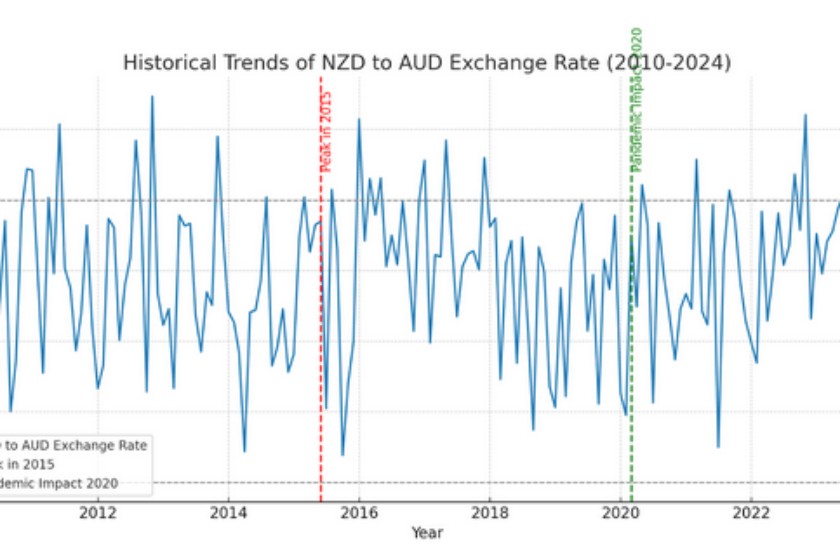

Think of it this way: currency exchange is like a seesaw. The NZD and AUD increase and decrease depending on economic trends, market activity, and global events. While these fluctuations may seem minor, they can add up.

Imagine exchanging $10,000 NZD at a rate that’s 0.02 higher—that’s an extra $200 AUD in your pocket. Over time, these little wins can grow into significant savings, which is why timing matters.

The Secret Recipe for Timing: What Influences the NZD to AUD Exchange Rate?

Timing isn’t just luck; it’s about understanding the forces behind the rate. Here’s what you need to know:

Economic Announcements: The Power of Central Banks

The Reserve Bank of New Zealand (RBNZ) and the Reserve Bank of Australia (RBA) play key roles in shaping exchange rates. They tweak interest rates, release economic updates, and adjust policies—all of which can cause the NZD and AUD to rise or fall.

Keep an eye out for…RBNZ and RBA meeting schedules, where interest rate changes and economic projections are often announced. These events can swing the exchange rate significantly.

Seasonal Trends: Timing That’s Written in the Calendar

Believe it or not, seasons play a part, too. For example:

- Tourism Season: The NZD often strengthens during New Zealand’s peak tourist season (December to March) when more foreign visitors flood in with cash.

- Export Activity: Australia’s mining exports ramp up during certain months, which can boost the AUD.

You can plan your exchanges to match favourable trends by understanding these patterns.

Global Events: Unpredictable but Important

Big global events—like elections, natural disasters, or geopolitical tensions—can shake up currency markets. While these are harder to predict, they can create opportunities if you act fast.

Pro Tip: Have a plan to react when major events create sudden rate changes.

Time of Day: Yes, It Matters!

Did you know that even the time of day can influence your exchange? Forex markets are active 24/7, but certain times of the day see more trading activity, which can result in better rates.

- Best Time to Act: Trading is typically at its most stable during the overlap of New Zealand and Australian business hours (10:00 AM–4:00 PM NZDT).

Tools to Help You Nail the Timing

Trying to time the market can feel overwhelming, but thankfully, there are tools to help you. Here are some of the best ones:

Exchange Rate Alerts: Let the Market Come to You

Set up rate alerts with Direct FX, and you’ll get notified when your desired rate is reached. It’s like having a personal assistant watching the market for you—so you can relax while staying in the loop.

Limit Orders: Lock in the Perfect Rate

A limit order allows you to set a specific exchange rate. If the market hits that rate, your transaction is executed automatically. This tool is great for making the most of sudden market moves.

Expert Insights: Stay One Step Ahead

Stay informed with forex updates and reports from Direct FX. Their team breaks down complex market trends into easy-to-understand insights, so you always feel confident about your timing.

When Are NZD to AUD Rates Usually Favourable?

While no one has a crystal ball, here are some common scenarios when the NZD to AUD rate might be more in your favour:

- Ahead of Tourism Seasons: As mentioned, New Zealand’s peak summer season often strengthens the NZD.

- During Economic Calm: When both economies are stable, the exchange rate tends to be more predictable.

- After Central Bank Announcements: For instance, if the RBA cuts interest rates while the RBNZ holds steady, the NZD may strengthen against the AUD.

How Direct FX Makes Timing Easy (And Saves You Money)

At Direct FX, we get it—timing your currency exchange can feel like a guessing game. That’s why we provide the tools, advice, and support to help you make the most of every dollar. Here’s how we make it simple:

- Competitive Rates: Our rates are tighter than what you’ll find at traditional banks, so you get more value for your money.

- Tailored Advice: Our team of experts offers personalized insights to help you time your transfers wisely.

- Flexible Options: From exchange rate alerts to limit orders, we offer solutions that adapt to your needs.

Three Smart Tips for Getting the Best Rate

- Plan Ahead: If you know you’ll need to make a transfer, start watching the market early to spot favourable trends.

- Split Large Transfers: For big amounts, consider breaking them into smaller transactions to spread risk.

- Ask for Help: Don’t hesitate to lean on the experts at Direct FX—they’re here to make the process stress-free

Timing Isn’t Everything… But It’s Close

While you can’t control the market, you *can* control how you approach it. By staying informed, using the right tools, and working with a trusted partner like Direct FX, you can make smarter, better-timed decisions for your NZD to AUD transfers.

So, what are you waiting for? Contact Direct FX today to start planning your next transfer—and make every dollar count.