Have you ever wondered why the NZD to AUD exchange rate seems to dance up and down like it has a mind of its own? If you’ve ever tried to send money between New Zealand and Australia, you’ve probably noticed how much even a small shift in the exchange rate can affect your transfer.

The truth is, there’s no single reason for these fluctuations. Instead, it’s a combination of local and global factors that influence how much a New Zealand dollar is worth in Australian dollars. Let’s break it down in a way that makes sense, so the next time someone mentions exchange rates, you’ll know exactly what’s behind those numbers.

1. The NZ-AUS Trade Connection: A Tale of Two Neighbors

If you’re transferring money from New Zealand to Australia (or vice versa), it’s worth remembering how close these two economies are. As neighbours, their trade relationship is one of the most significant factors influencing the exchange rate.

Exports and Imports Matter: When New Zealand exports more goods to Australia, it increases demand for the NZD. Similarly, when Australians buy more goods from New Zealand, the AUD strengthens.

Shared Commodities: The two countries are big players in the commodity market—New Zealand with its dairy and meat exports, and Australia with iron ore and coal. If global demand for iron ore spikes, for example, it could push the AUD higher against the NZD.

Think of it like this: trade is the heartbeat of these currencies. Any time one country starts exporting more (or importing less), it creates ripples in the exchange rate.

2. Commodities: The Invisible Puppeteers

We mentioned commodities like dairy and iron, but their impact on the NZD and AUD goes even deeper. These two currencies are often referred to as “commodity currencies” because their value is heavily tied to what the world is willing to pay for their exports.

When global dairy prices rise, New Zealand gets a boost because, well, we’re famous for our milk and cheese!

If iron prices drop, Australia feels the pinch since it’s a huge part of their economy.

And here’s a fun fact: major economies like China play a big role here. Both New Zealand and Australia export a lot to China, so any slowdown (or boom) in Chinese demand can affect both currencies.

3. Central Banks: The Rate Setters

Here’s where it gets a bit more technical—this is important. Both New Zealand’s Reserve Bank (RBNZ) and Australia’s Reserve Bank (RBA) influence their respective currencies through interest rates and monetary policies.

- Interest Rates: Higher interest rates tend to attract foreign investment, strengthening a country’s currency. So, if the RBNZ raises rates while the RBA keeps them steady, the NZD might gain an edge over the AUD.

- Inflation Control: Central banks adjust interest rates to control inflation. If inflation is high in Australia but low in New Zealand, the RBA might act differently from the RBNZ, which can shift the exchange rate.

Central banks are like the puppeteers of the currency world. They don’t control everything, but their actions set the tone for how their currencies perform globally.

4. Economic Growth and Employment: The Big Picture

A strong economy usually means a strong currency, which applies to New Zealand and Australia.

- GDP Growth: If New Zealand’s economy is growing faster than Australia’s, the NZD often gains strength because investors see it as a good place to put their money.

- Job Market: Employment rates also play a role. Low unemployment signals a healthy economy, which can boost the currency.

So, when you hear about economic growth or unemployment figures in the news, know that it’s not just numbers—it’s a signal of what might happen to exchange rates.

5. Global Events: The Wild Cards

Now, let’s zoom out for a second. While local factors like trade and central bank policies are critical, global events often act like wild cards in the currency game.

- Market Sentiment: When the global economy feels shaky, investors tend to flock to “safe-haven” currencies like the US dollar. This can weaken both the NZD and AUD.

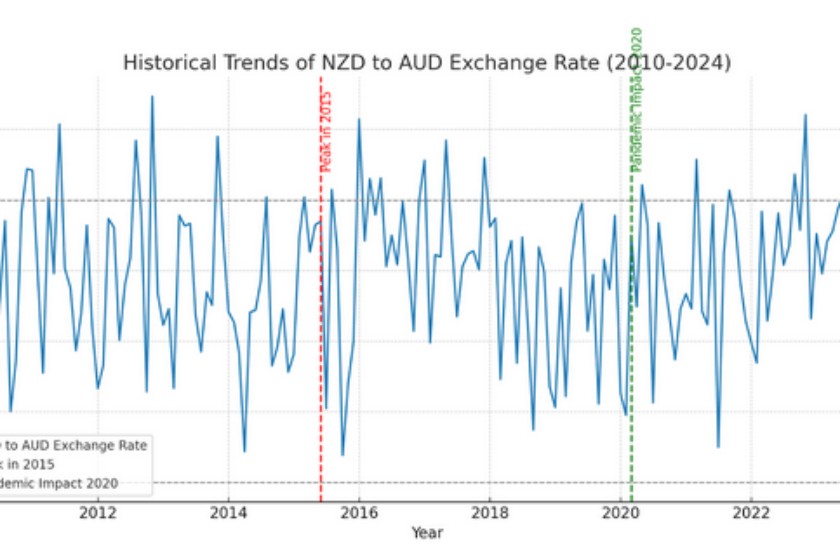

- Geopolitical Events: Trade wars, political instability, or even natural disasters can create sudden shifts. Remember the impact of COVID-19? It rocked every major currency, including the NZD and AUD.

- Global Trends: Things like energy prices, climate events, or even emerging tech sectors can unexpectedly influence currencies.

The takeaway? Sometimes it’s not about what’s happening in New Zealand or Australia but what’s happening in the rest of the world.

6. How to Stay Ahead of Exchange Rate Changes

Alright, so we’ve covered the “why” behind NZD and AUD fluctuations. But what can you do about it? Here’s how to make sure you’re not caught off guard when sending money between these two currencies:

- Keep an Eye on Rates: Use tools like Direct FX’s live rate tracker to monitor changes in real-time.

- Plan Ahead: If you know you’ll need to make a transfer, consider using a forward contract to lock in today’s rate for a future transaction.

- Set Alerts: Direct FX lets you set a target rate, so you’ll get notified when the exchange rate hits your desired level.

- Talk to the Experts: Whether you’re transferring a small amount or making a big international payment, having someone guide you through the process can save you money—and stress.

Why Choose Direct FX for Your NZD to AUD Transfers?

Let’s face it: no one can predict exchange rates with 100% accuracy. But what you can control is who you trust to handle your transfers. Here’s why Direct FX stands out:

- Unbeatable Rates: With access to interbank rates, Direct FX ensures you get more value for every NZD or AUD exchanged.

- Tailored Advice: Their team of experts provides insights based on your unique situation, whether managing personal finances or running a business.

- Secure and Fast Transfers: Direct FX’s systems are designed to ensure your money arrives safely and on time.

- Zero Hidden Fees: What you see is what you get—no nasty surprises.

Final Thoughts: Knowledge is Power

Understanding the factors influencing the NZD to AUD exchange rate isn’t just for economists or forex traders—it’s for anyone who wants to make smarter financial decisions. Whether transferring money for personal reasons, business transactions, or even investments, staying informed gives you the upper hand.

At Direct FX, we don’t just handle your money—we empower you with the tools and knowledge to make the most of your transfers. So, the next time you watch the NZD to AUD exchange rate, you’ll know exactly what’s driving it—and how to make it work in your favour.