The exchange rate between the New Zealand Dollar (NZD) and the Australian Dollar (AUD) has seen significant fluctuations over the past decade. Understanding these trends can provide valuable insights for businesses and individuals involved in foreign exchange transactions. This blog delves into the key factors influencing the NZD to AUD exchange rate, examining notable historical trends and their implications.

1. Introduction to NZD and AUD

The NZD and AUD are two of the most traded currencies in the world, largely due to the close economic ties between New Zealand and Australia. Both countries have robust export-oriented economies with significant reliance on commodities. However, their economic policies, interest rates, and other macroeconomic factors often diverge, leading to fluctuations in their exchange rate.

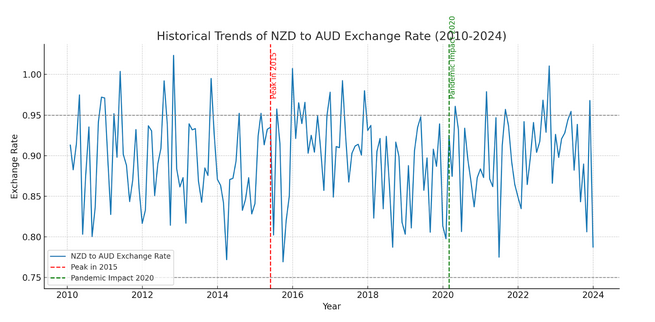

2. Overview of Historical Trends

2010-2012: Post-Global Financial Crisis Recovery

In the aftermath of the global financial crisis, the NZD and AUD experienced a recovery phase. However, the NZD to AUD exchange rate was relatively stable during this period, hovering around the 0.7400 to 0.8000 range. This stability was attributed to synchronised economic recoveries in both countries, supported by strong demand for commodities, particularly from China.

2013-2015: Diverging Economic Policies

Between 2013 and 2015, the exchange rate saw a significant shift. The Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) adopted divergent monetary policies. While the RBA maintained a lower interest rate to stimulate the economy, the RBNZ raised rates to combat rising housing prices. This divergence caused the NZD to strengthen against the AUD, peaking at around 0.9980 (parity) in mid-2015.

2016-2018: Commodity Price Volatility

During this period, fluctuations in commodity prices, particularly dairy products for New Zealand and iron ore for Australia, played a crucial role. The NZD experienced volatility due to fluctuating global dairy prices, while the AUD was impacted by changes in iron ore prices. The exchange rate fluctuated between 0.9000 and 0.9650, reflecting these commodity market dynamics.

2019-2020: Global Economic Uncertainty

The onset of global economic uncertainty in 2019, exacerbated by the COVID-19 pandemic in 2020, led to heightened volatility in the exchange rate. The NZD to AUD exchange rate dropped sharply as investors flocked to safe-haven currencies. However, both countries’ swift fiscal and monetary responses helped stabilise the exchange rate, which hovered around 0.9450 by the end of 2020.

2021-Present: Recovery and Economic Reforms

As the global economy started recovering from the pandemic, New Zealand and Australia implemented significant economic reforms. These included fiscal stimulus measures, infrastructure investments, and efforts to boost domestic industries. The exchange rate has seen a gradual strengthening of the NZD, trading within the 0.8750 to 0.9350 range in recent times.

3. Key Factors Influencing the NZD to AUD Exchange Rate

Interest Rate Differentials

The differences in interest rates set by the RBA and RBNZ have historically been a major driver of the exchange rate. Higher interest rates in New Zealand relative to Australia tend to strengthen the NZD against the AUD and vice versa.

Commodity Prices

Both economies are heavily reliant on commodity exports, so fluctuations in global commodity prices significantly impact their currencies. For example, rising dairy prices benefit the NZD, while increasing iron ore prices support the AUD.

Economic Data and Indicators

Economic indicators such as GDP growth, employment rates, and inflation levels influence investor sentiment and, consequently, the exchange rate. Positive economic data from either country can strengthen its currency.

Global Economic Events

Global events such as financial crises, geopolitical tensions, and changes in trade policies also affect the NZD to AUD exchange rate. Investors tend to seek safe-haven currencies during global uncertainty, impacting both the NZD and AUD.

4. Implications for Businesses and Individuals

Understanding historical NZD to AUD exchange rate trends is crucial for businesses and individuals engaged in cross-border transactions. For exporters and importers, these trends help them make informed decisions about hedging strategies and the timing of transactions to minimise currency risk. For investors, analysing these trends can aid in making strategic investment decisions in forex markets.

5. Future Outlook

While historical trends provide valuable insights, predicting future movements in the NZD to AUD exchange rate involves considering various factors. Ongoing economic policies, global trade dynamics, and unforeseen events will continue to shape the exchange rate landscape. Staying informed and working with experienced forex advisors like Direct FX can help navigate this complex environment.

The historical trends of the NZD to AUD exchange rate highlight the dynamic nature of forex markets. Businesses and individuals can better manage their foreign exchange transactions by understanding the key drivers and patterns. Direct FX remains committed to providing expert guidance and competitive rates to help clients navigate these trends effectively.