Market Overview

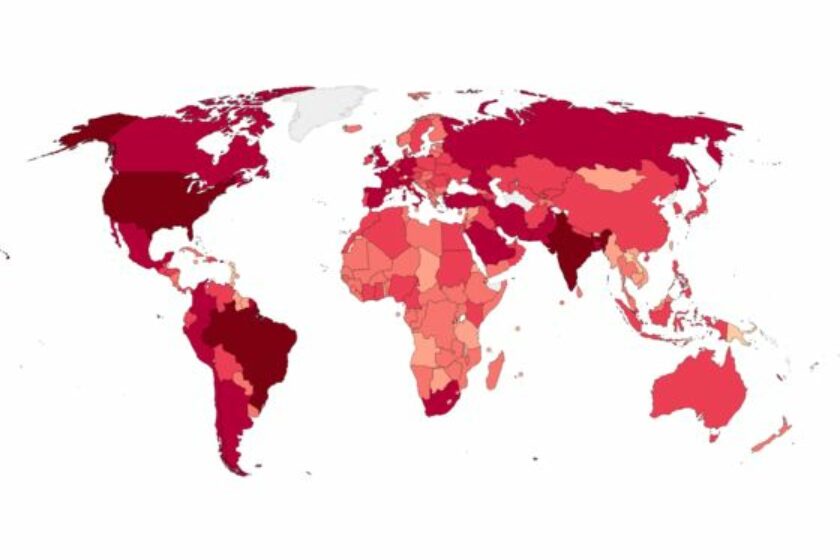

• Worldwide coronavirus cases surpass 250.495 million with over 5.068 million official

deaths.

• New Zealand has 2754 active cases of coronavirus with 190 new cases today and 1 death. Meanwhile, the Australian State of New South Wales reported 187 new cases and 4 deaths yesterday with Victoria reporting 1126 new cases with 5 deaths

• The S&P closed at a record level for the seventh straight day Friday while the NASDAQ has closed at a record level for 43 days this year.

• Federal Reserve’s Bullard expects more than 4% GDP growth in 2022 and 2 rate hikes

• ECB’s Lane says extensive accommodation is needed to build up inflationary pressure

• The New Zealand Dollar was the strongest major currency Monday Read more