Weekly FX Recap: 2021-07-30

FX Update:

The Federal Reserve Rate announcement and Monetary Policy Thursday morning was “as predicted” with investors expecting the Fed to hold rates to near zero and continue with their asset buying. Markets were keen to see what road chairman Jerome Powell would head down with inflation and tapering of their bond buying program. Powell stuck with the 120B bond buying but said the economy has made progress recently toward jobs and inflation goals but would continue to assess progress in the upcoming meetings. On one side it looks as if they should start tapering, but on the other hand they have the unemployment picture showing they are not quite ready to pull the trigger – also coupled with coronavirus cases increases concerns. In summary we don’t think the Fed could have been more dovish in their stance on current policy and where things are headed over the rest of 2021. Stock markets held steady post the release but with the Fed potentially ready to fire a warning shot in upcoming meetings we could see equity markets pull back off record highs and put a halt to any upside momentum in the New Zealand Dollar. The Greenback also weakened off across the board following the Fed release with the overall tone being, the Fed will keep a soft policy approach until well into 2022-2023.

Key Points:

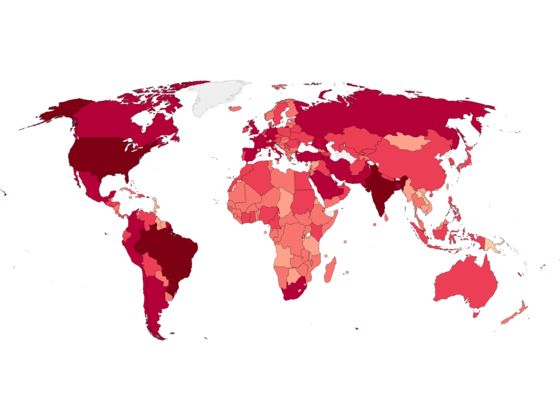

- Worldwide coronavirus cases surpass 197.310 million with over 4.213 million official deaths.

- Australian CPI y/y jumped from 1.1% in May 3.8% in June y/y

- Sydney, Australia has reported another 170 new cases of coronavirus in the past 24 hours of which 42 were in the community.

- New Zealand’s Medal Tally- 2 Gold, 3 Silver, 1 Bronze

- Emma Twigg wins gold in the Women’s Single Scull, an unbelievable effort in her 4th Olympic games.

- Japan extends the state of emergency to Osaka today, Tokyo has reported 3,865 cases over the last day