Powerful Download Engine

IDM is known for its powerful download engine that helps users manage their downloads effectively. With the idm full crack download, you can unlock all the features of this amazing tool without spending any money. Many people look for ways to download idm crack to enjoy the benefits of faster downloads.

Using idm crack free download allows users to take advantage of the software's capabilities. This includes managing multiple downloads at once and ensuring that files are downloaded quickly and efficiently.

How IDM Enhances Download Speeds

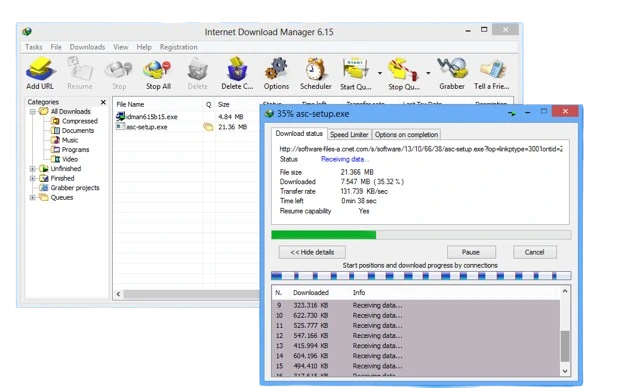

One of the main reasons people love IDM is its ability to increase download speed. The software uses a special technique for increasing download speed, which helps users download files much faster than with regular browsers.

IDM also allows you to set up a download queue, so you can organize your downloads and make sure everything is downloaded in the order you want. This feature is especially useful for users who download large files or multiple items at once.

Features of IDM That Improve Performance

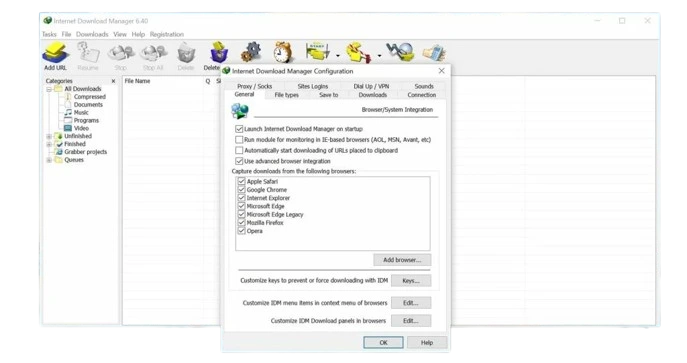

IDM offers several features that improve its performance. One of these is idm integration with popular web browsers, making it easy to download files directly from the internet.

The user interface of IDM is designed to be user-friendly, allowing even beginners to navigate the software easily. With the latest version, users can enjoy improved features and better performance, ensuring a smooth downloading experience.

| Feature | Description |

|---|---|

| Download Speed Boost | Increases download speeds significantly |

| Download Queue | Organizes downloads for better management |

| Browser Integration | Works seamlessly with popular browsers |

| User-Friendly Interface | Easy to navigate for all users |

Download Files from Your Favorite Websites

Downloading files from various web sites is a common activity for many internet users. With the right tools, you can easily download files of different file types. One popular tool for this purpose is Internet Download Manager (IDM). It helps users manage their downloads efficiently and quickly.

Using IDM, you can download files from your favorite web sites without any hassle. The software supports various file types, making it versatile for different downloading needs.

Supported Sites for Downloading with IDM

IDM works well with many popular web sites. Here are some examples of sites where you can use IDM to download files:

- Video streaming sites

- Music download sites

- Document sharing platforms

- Software distribution sites

If you are looking for ways to enhance your downloading experience, you might consider using the idm download crack version. This version allows you to access all features of IDM without paying for it. Many users search for crack idm download to find this option.

How to Use IDM for Video Downloads

Using IDM for video downloads is simple and effective. First, make sure you have the idm download free full version with crack installed on your device. This version gives you full access to all features.

To download videos, follow these steps:

- Open your web browser and go to the video site.

- Play the video you want to download.

- IDM will automatically detect the video and show a download button.

- Click the button to start downloading.

For the best experience, always download idm latest version with crack to ensure you have the latest features and improvements.

Download Categories

When using Internet Download Manager (IDM), you can organize your downloads into different categories. This helps you find your files easily and keeps everything neat. Customizing download categories in IDM is a great way to manage your downloads better.

You can create categories like:

- Music

- Videos

- Documents

- Software

This way, you can quickly locate what you need without searching through a long list of files.

Organizing Your Downloads with IDM

With the help of IDM crack patch download 64 bit, you can unlock features that make organizing your downloads even easier. You can set rules for each category, so files automatically go to the right place.

Here’s how you can organize your downloads:

- Open IDM.

- Go to the "Categories" section.

- Create a new category or edit an existing one.

- Set rules for file types.

This makes it simple to keep your downloads sorted and easy to find. If you want to enjoy all these features, you can download full crack idm to get the complete experience.

Customizing Download Categories in IDM

Customizing download categories in IDM allows you to tailor your downloading experience. With idm crack patch download, you can access advanced features that help you manage your downloads more effectively.

To customize your categories, follow these steps:

- Open IDM and go to "Options."

- Click on the "Categories" tab.

- Add or modify categories as needed.

- Assign file types to each category.

You can also use idm free crack download to enjoy these customization options without any cost. This way, you can make sure your downloads are organized just the way you like them.

Customizable Interface

The customizable interface of Internet Download Manager (IDM) allows users to tailor their experience according to their preferences. This feature is especially useful for those who want to make their downloading process more efficient and enjoyable.

You can easily install IDM and start exploring its customizable options. The interface is designed to be user-friendly, making it accessible for everyone, including beginners.

Personalizing Your IDM Experience

Personalizing your IDM experience can make downloading files more enjoyable. With the idm with crack free download, you can unlock additional features that enhance your user interface.

Here are some ways to personalize your IDM:

- Change the theme or color scheme

- Rearrange toolbars for easy access

- Customize download categories

By using the idm crack latest version free download for lifetime, you can enjoy these personalized features without any limitations.

Tips for Optimizing IDM Settings

Optimizing your IDM settings can greatly improve your downloading experience. If you want to make the most out of your downloads, consider the following tips:

- Adjust download speed settings

- Enable browser integration for easier access

- Set up a download queue for better organization

To access these features, you can download IDM with crack and enjoy the benefits of the idm crack version download. This way, you can ensure that your downloading process is as smooth as possible.

Installation Instructions

Installing IDM with a crack can be a straightforward process if you follow the right steps. Here’s how you can do it easily.

Step-by-Step Guide to Install IDM Crack

- Download IDM Crack: Start by finding the idm crack download for pc that suits your system.

- Extract the Files: Use a tool to extract the idm full version with crack free download rar 64 bit files.

- Run the Installer: Open the extracted folder and run the installer.

- Follow the Prompts: Follow the on-screen instructions to complete the installation.

- Apply the Crack: After installation, locate the crack file and apply it to the IDM installation folder.

- Restart IDM: Open IDM to ensure that the crack has been applied successfully.

Troubleshooting Common Installation Issues

Sometimes, you may face issues while installing IDM. Here are some common problems and solutions.

- Installation Fails: Ensure that you have downloaded idm crack download 2024 correctly and that your system meets the requirements.

- Crack Not Working: Make sure you have followed all steps for the idm crack full download properly.

- Missing Files: If some files are missing, re-download the package and try again.

FAQ

Many people have questions about using IDM crack. Here are some common inquiries and their answers.

What is IDM Crack?

IDM crack refers to a modified version of Internet Download Manager that allows users to access the full features without paying for it.

Many users search for idm crack download to find this version. It is popular among those who want to enjoy the benefits of the software for free.

Is it safe to use IDM Crack?

Using idm crack latest version free download for lifetime can come with risks. Since it is a modified version, it may not be safe.

You might encounter issues like malware or viruses. Additionally, using idm crack patch download can lead to problems with software updates and support.

How can I update IDM after using a crack?

Updating IDM after using a crack can be tricky. If you have the idm full version with crack free download, you may need to uninstall the cracked version first.

Then, you can download idm latest version with crack to ensure you have the most recent features. Always be cautious when updating cracked software to avoid losing access to its features.